Are you ready for the new Hong Kong Transfer Pricing Regime?

By Steven Kwan

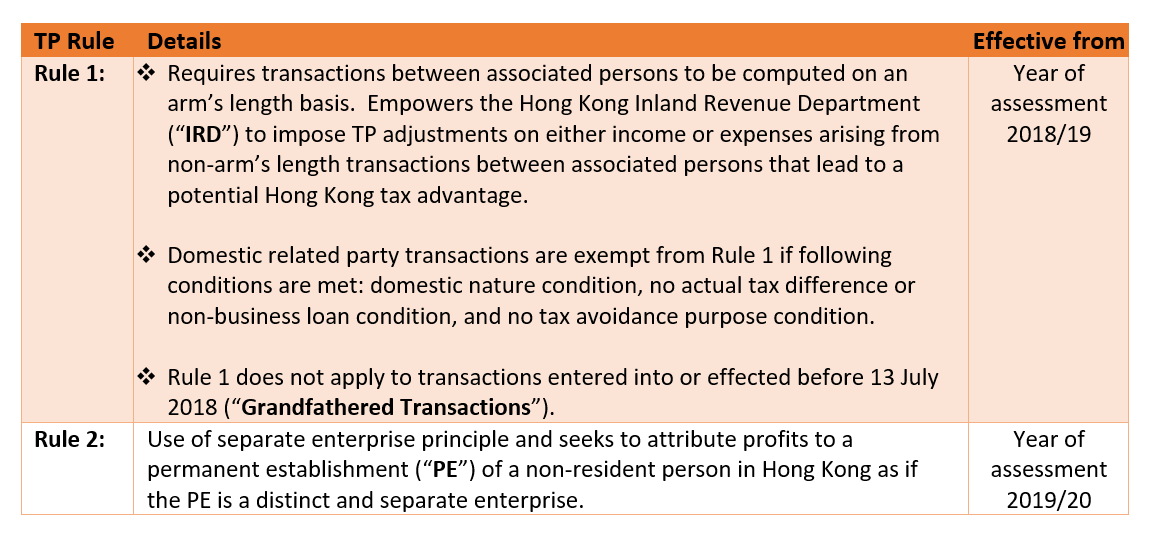

Hong Kong has formally implemented the Transfer Pricing (“TP”) regulatory regime with effect from the year of assessment 2018/19. The TP regime codifies the arm’s length principle of TP into the Inland Revenue Ordinance through the following TP Rules and documentation requirements.

TP Rules:

TP Documentation requirements:

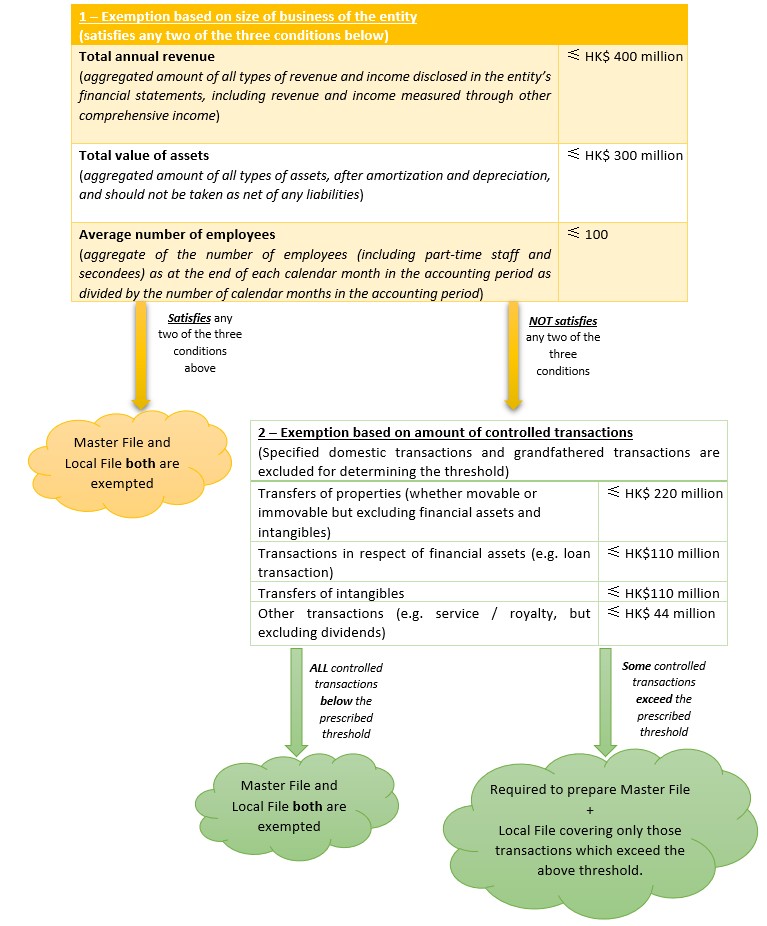

Hong Kong follows the OECD’s three-tiered standardized approach for transfer pricing documentation, includes Master File, Local File and Country-by-Country (“CbC”) Report. Exemption thresholds are provided for preparing Master File, Local File and CbC Report.

1. Master File and Local File

Master File containing standardized information relevant for all constituent entities of the group.

Local File referring to material transactions of a specific constituent entity of the group.

- Effective date: Accounting periods beginning on or after 1 April 2018

- Due date for preparation: within 9 months after the end of that account period

- Retention period: not less than 7 years after the end of the accounting period

- Language: English or Chinese

- Penalty for non-compliance without reasonable excuse: fine at level 5 (HK$50,000) and court order, a further fine at level 6 (HK$100,000) for non-compliance with the court order

- Two exemption thresholds for preparing Master File and Local File:

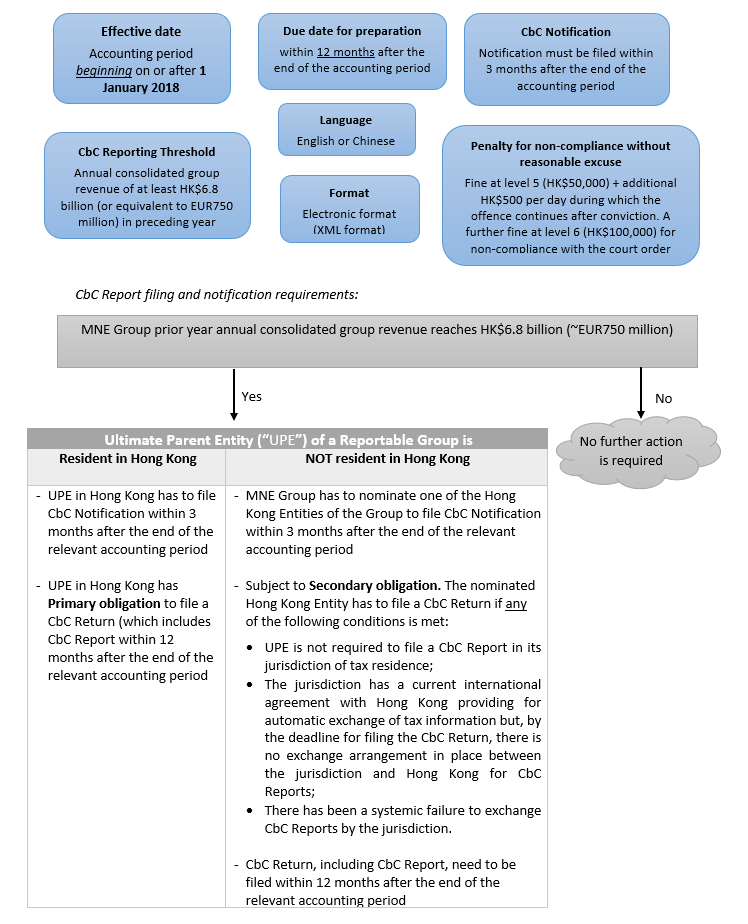

2. CbC Report

CbC Report contains information relating to the global allocation of income and taxes paid together with certain indicators of the location of economic activities of a multinational enterprises (“MNE”) group.

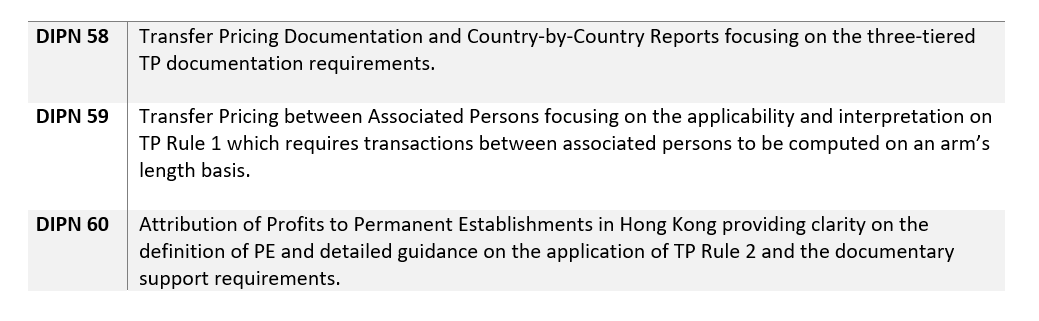

Departmental Interpretation and Practice Notes (“DIPN”) issued

The IRD has issued following DIPNs on 19 July 2019 setting out its interpretation and guidance on the relevant TP rules and requirements as well as the latest international standards relating to transfer pricing:

Even if a Hong Kong company meets the exemption thresholds and is not required to prepare Master File and Local File for the relevant accounting year, the company is still required to comply with the TP Rule 1. DIPN 58 emphasises that proper transfer pricing documentation can serve as a defence for transfer pricing treatment and having a comprehensive TP documentation can mitigate penalty exposure in tax or TP examination/audits.

The IRD has updated the penalty policy in September 2019 on its website to include the major penalty provisions in relation to relief from double taxation, exchange of information, transfer pricing requirements, advance pricing arrangement, mutual agreement procedure and arbitration, etc.

Frequently asked questions:

Q1: Are Hong Kong companies with offshore profits claim have to be subject to Rule 1 on their transactions with associated persons?

Hong Kong adopts a territorial source principle of taxation, profits derived from a source outside Hong Kong are not taxable in Hong Kong. The long-established territorial source principle of taxation will not be affected by the introduction of the TP ordinance.

However, DIPN 59 states that taxpayers should first determine the arm’s length price of the transactions with associated persons before territorial source principle is applied to determine the chargeability of income or profit to Hong Kong profits tax. Thus, Hong Kong companies with offshore profits claim should also be subject to Rule 1 on their transactions with associated persons.

Q2: How intercompany transactions can be qualified as Grandfathered Transactions in which exempted from Rule 1?

DIPN 59 clarifies that Grandfathered Transactions exemption applies to a transaction and not to a contract. The signing of a master agreement might not necessarily result in a transaction. The key question is whether the act or activity can constitute a transaction on its own before 13 July 2018. Each transaction should be considered on a case by case basis. Examples are provided in DIPN59.

Q3: In preparing the Local File of the entity, do we need to cover controlled transactions which generate offshore sourced income or profits?

Yes. DIPN 58 has further clarified that the local file of a Hong Kong entity in respect of an accounting period is required to cover transaction(s) even if the income or profits from the transaction(s) are or claimed to be sourced outside Hong Kong.

Q4: Our group has 3 companies in Hong Kong, do we need to file CbC Notification for each company before the deadline?

For a Reportable Group with more than one Hong Kong Entity, one of the Hong Kong Entities of the Reportable Group can be nominated to file a CbC Reporting Notification for all Hong Kong Entities of the Reportable Group. A CbC Reporting Notification must be filed with the IRD electronically via the Portal within 3 months after the accounting year-end date of the Reportable Group.